One of the first steps you take when moving to a new country is opening a bank account, a chore I recently faced. It didn’t go as smoothly as I’d imagined, and my professional self had something to say about it, being both a “modern consumer” and a “brand strategist.”

If, like yours truly, you have always imagined Switzerland as being the crème de la crème (de Gruyère) of the banking industry, with state-of-the-art, never-seen-before financial services, well, think again! I was pretty amazed to notice a distinct lack of innovation — not to say common sense — on the part of some of the most world-renowned retail banking actors. Moreover, the recent financial crisis has sent a chill across the global financial ecosystem: retail banks have lost what was left of their customers’ trust, mine included.

Yet we have seen major trends reshaping every industry, including the banking sector. For this post, I’ll take a fun look at breakthrough initiatives that will have a strong impact on financial organizations, their branding, and, most importantly, the way they design a successful customer experience.

Mobile First

By 2020, over 70 percent of the global population will own a smartphone, and with such device at one’s fingertips, anytime and anywhere, banks are just one of many sectors facing a fast-moving and inevitable challenge: the digitization of their activities. In some cases, this trend will have a crucial impact on their business model, but only for the good if they’re willing to embrace the challenge.

According to a mobile and online survey by Juniper Research, there will be more mobile banking users than online banking users by the end of 2019. Some actors have already developed a mobile-first service to address this not-so-new customer trend. (Fun fact: Kenya might be the flagship country where the impact of mobile-only banking is the strongest, since the majority of citizens are unbanked yet own a mobile phone.) But consumer banking is not the only sector being affected by the mobile-first trend.

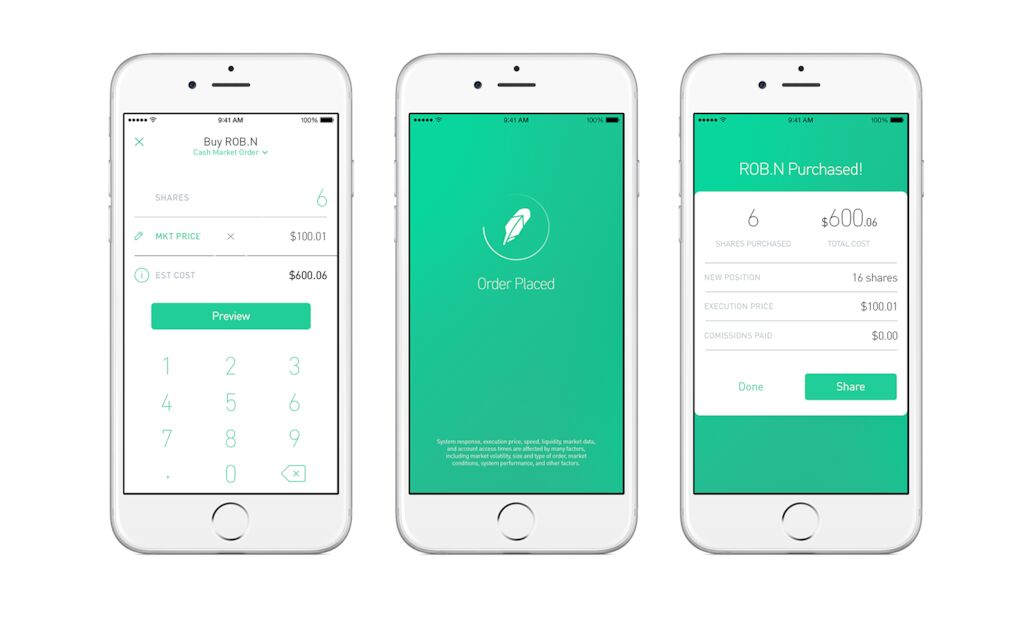

Launched over a year ago, Robinhood is aiming to democratize the expensive and dusty business of stock trading with a free, beautifully designed, and easy-to-use app.